Understanding the GST Registration Limit for Services in India 2025

When you’re running a service-based business, the difference between staying compliant and falling behind the regulatory curve is understanding the GST registration limit. Too many businesses wait too long to get registered, only to find themselves struggling with penalties. The best approach is simple: know your threshold and stay ahead.

Every small service firm, from consultants to design studios, faces this line between compliance and comfort. The rules are clear, but when you cross the GST registration turnover limit, things get serious. If you don’t know when to register, you’re opening the door to legal challenges and penalties.

In this blog, we’ll unpack the essentials: GST thresholds, mandatory cases for registration, voluntary registration options, and the composition scheme for smaller service providers.

What Is the GST Registration Limit for Services?

To understand when GST registration applies, we need to break down the idea of aggregate turnover. This is the total value of taxable, exempt, and export services your business provides across India under one PAN. It includes everything, whether it’s the revenue from your invoices or even exempt services like healthcare or education. However, the key point is:

- ₹20 lakh: this is the baseline limit for most states. If your turnover crosses this in a given financial year, GST registration becomes mandatory.

- ₹10 lakh: this is the reduced limit for special category states like Mizoram, Nagaland, Tripura, and Manipur.

For goods, the threshold is ₹40 lakh, but this does not extend to services. So, if you’re offering professional services like consulting, IT, legal, healthcare, or education, the GST registration limit for services is firmly set at ₹20 lakh (₹10 lakh in special states).

Knowing where your business falls under this threshold decides when registration becomes a necessity, not a choice.

Key Definitions That Shape GST Applicability

Understanding the GST registration limit requires a clear understanding of the key terms. Here’s a quick guide to the definitions that matter most:

- Aggregate Turnover (AATO): This refers to the total value of all taxable, exempt, export, and inter-state supplies made by your business across India under one PAN. It doesn’t include GST or inward supplies under Reverse Charge.

- Special Category States: These are regions where the government has set a lower GST registration limit of ₹10 lakh due to geographical or economic factors.

- Taxable vs Exempt Services: Taxable services are those that attract GST. Exempt services, like healthcare or education, still contribute to the turnover but do not attract any tax. For example, a hospital or school’s turnover still counts towards the ₹20 lakh limit, but they don’t pay GST on it.

It’s important to remember that aggregate turnover applies to your PAN level, not to individual state or region turnover. This means your turnover from services in every part of India counts toward your GST registration limit.

When GST Registration Becomes Mandatory

Here’s the thing. Cross the limit and GST registration is not optional. But some cases make it compulsory even when you’re below the line. Section 24 of the CGST Act says so. Details are as follows:

- Inter-State Suppliers: If your supplies/services travel between states, GST registration is mandatory, even if your turnover is below the ₹20 lakh threshold.

- Casual Taxable Persons: This applies if you’re temporarily conducting business but need to register because of the nature of your operations.

- Non-resident Taxable Persons: You are a foreign business selling services in India. You register before you start work. No workaround.

- Reverse Charge Liabilities: If you’re required to pay tax under the reverse charge mechanism, GST registration is mandatory.

- E-Commerce Operators: Businesses that deal with e-commerce platforms also need to get registered.

- Input Service Distributors: Businesses that redistribute credit need to be GST-compliant.

- TDS/TCS Deductors: If you’re deducting tax at source (TDS) or collecting tax at source (TCS), you must be registered under GST.

- OIDAR Services: For Online Information and Database Access or Retrieval services, GST registration is a must.

In essence, if your business falls into any of these categories, you cannot avoid GST registration, regardless of whether you’ve crossed the standard ₹20 lakh limit. Many professionals, especially those working across states, will find themselves caught by this rule, even if their business turnover remains below the standard threshold.

GST Threshold Limits for Services: FY 2025-26

Understanding the GST turnover limit for services is essential, especially if you’re expanding or planning to register for GST. Here’s a breakdown of the applicable limits for the 2025-26 financial year:

| Type | Turnover Limit | States |

|---|---|---|

| General States | ₹20 Lakhs | All except those below |

| Special Category States | ₹10 Lakhs | Mizoram, Nagaland, Tripura, Manipur |

| Goods (for reference) | ₹40 Lakhs | Not applicable to services |

It’s important to note that the GST Council revises these limits periodically. For the latest updates, you can always refer to the CBIC official threshold notice.

Composition Scheme for Service Providers

If you fall under the GST registration exemption limit (turnover under ₹50 lakh), you might be eligible for the composition scheme. This scheme allows service providers to pay tax at a reduced rate of 6% instead of the standard rates.

However, there are conditions to be aware of:

- You cannot issue tax invoices that allow Input Tax Credit (ITC).

- You cannot collect GST from your customers directly.

- The tax is paid from your own funds, meaning no input credits are claimed.

Who should consider the composition scheme? Typically, small consultants, freelancers, and B2C service providers with low input taxes should think about this. It simplifies the tax process but comes with the trade-off of no ITC.

If simplicity is your priority over claiming tax credits, this option works well.

Voluntary Registration and Its Hidden Costs

What if you’re well below the minimum turnover for GST registration but still decide to register voluntarily? This is an option for businesses that want to claim Input Tax Credit (ITC) or enhance credibility. However, it comes with its own set of challenges:

- Return filing obligations: With voluntary registration, you will need to file returns monthly or quarterly, even if you don’t have much business activity.

- Accounting overhead: The administrative burden increases with the need for accurate record-keeping and filing.

- Possible ITC reversals: If you deal with exempt supplies, the ITC you’ve claimed might be reversed.

For example, a freelance designer in Bangalore who registers voluntarily but doesn’t have many inputs may see their profit margins shrink as they deal with extra paperwork and reverse charges on exempt supplies. It’s crucial to only register voluntarily if the potential ITC savings outweigh the cost of compliance.

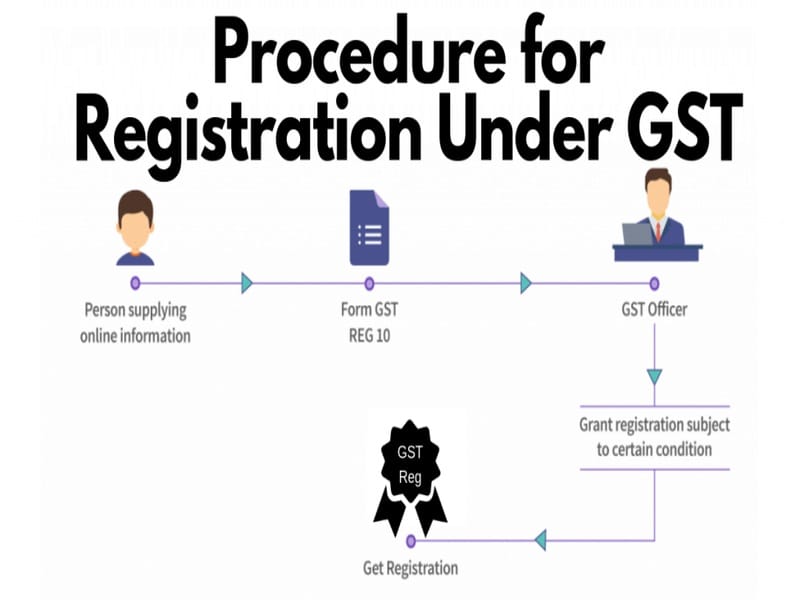

Step-by-Step GST Registration Process for Services

If your business crosses the turnover limit for GST registration, or if you’re opting for voluntary registration, the process is straightforward. Here’s how to proceed:

- Visit gst.gov.in and create your profile.

- Fill in REG-01 with your PAN, business details, and registered office address.

- Upload required documents: PAN, Aadhaar, business proof, utility bill, rent deed, and bank details.

- Complete Aadhaar Authentication for faster approval.

- Wait for officer verification and physical visit (if applicable).

- Receive your GSTIN (Goods and Services Tax Identification Number) through REG-06.

Approval typically takes 2–6 working days, depending on document accuracy. Be mindful that missing signage photos or mismatched addresses can delay your approval.

If you want a single line of control: EaseMyOffice handles the GST/MCA-ready doc pack, signage support, and mail handling so you file once, track once, and move on with work.

Common Mistakes and Penalties

Some of the most common mistakes in GST registration include:

- Misclassifying exports as exempt services

- Using outdated utility bills (more than 2 months old)

- Submitting an address that doesn’t match the rent deed

- Ignoring signage requirements during verification

Penalties for errors can be severe:

- Failure to register: 10% of tax due or ₹10,000 (whichever is higher)

- Non-filing of returns: ₹50/day (₹20/day for NIL returns)

- Wrong ITC claim: 24% interest + penalty

Most penalties arise from oversight, not intent. Staying aware of these mistakes can keep you on the right track.

Conclusion

Knowing your GST registration turnover limit can help stay out of trouble. For services, the line sits at ₹20 lakh in most states and ₹10 lakh in special states. Professionals, exporters, and small providers can hit mandatory rules even earlier.

Register on time. This way, you’ll protect cash, avoid notices, and earn client trust. Don’t wait for a sudden spike in sales. Get compliant now and keep the business clean, steady, and credible.

Faqs

Q1. What is the limit of GST on services?

₹20 lakh in most states. ₹10 lakh in special category states like Mizoram, Nagaland, Tripura, and Manipur. That is the line for services.

Q2. Is ₹20 lakhs the GST registration limit?

Yes, for service providers in general-category states. Goods can go up to ₹40 lakh, but that higher limit does not apply to services.

Q3. What is the GST limit for consultancy services?

Consultants and freelancers follow the same rule. ₹20 lakh in most states. ₹10 lakh if you operate from a special category state. Check turnover at the PAN level.

Q4. What is the compulsory GST registration limit for service providers?

Cross ₹20 lakh (or ₹10 lakh) and you must register. Also register even below the limit if Section 24 applies, like inter-state services, e-commerce supplies, reverse charge liability, or ISD/TDS/TCS roles.

Q5. What is the minimum sales for GST registration?

When aggregate turnover under one PAN crosses ₹20 lakh, or ₹10 lakh in special states. Aggregate means taxable, exempt, and export services together. GST itself is not counted in that number.Q6. What happens if I exceed the limit mid-year?

Apply within 30 days of crossing. GST liability starts from the date you crossed the limit. Delay brings backdated tax, interest, and penalties.