How to Check MSME Registration by GST Number or PAN 2025

An invoice lands on your desk. At the bottom, in smaller letters, the supplier calls themselves MSME. That one tag looks harmless, but it flips the clock on your payments. Once you deal with an MSME registration, Section 43B(h) of the Income Tax Act tells you the bill must be cleared within 45 days. Delay it, and you don’t just annoy a vendor. You lose your tax deduction.

Now put that in real life. Accounts payable teams suddenly juggle cash flow to clear one invoice before the rest. Procurement managers filter tenders because MSME bidders get preference. Founders scrambling for funding must explain why vendor dues are delayed. Even freelancers and virtual office operators face the question when a client flashes an MSME certificate. The rules hit everyone who deals with small enterprises, not just banks or corporates.

And here’s the mistake people make. They think typing a GSTIN into a search bar will spit out MSME status like a light switch. It doesn’t. GST tells you tax identity. MSME lives on the Udyam portal. The link between them is PAN or the Udyam Registration Number. Miss that link, and you are working blind.

Cash Flow Risk

One late MSME payment can throw compliance out of shape. The cost is not in penalties alone. It is in the time wasted answering auditors and regulators who ask why.

Why MSME Verification Matters Before You Pay or Partner

Trusting a supplier’s word is easy. But proof keeps you safe. A proper check on Udyam puts evidence on file, so when the audit comes you have facts, not assumptions.

This is why MSME verification matters. It is not paperwork. It is the difference between a smooth quarter close and a scramble to explain why deductions vanished.

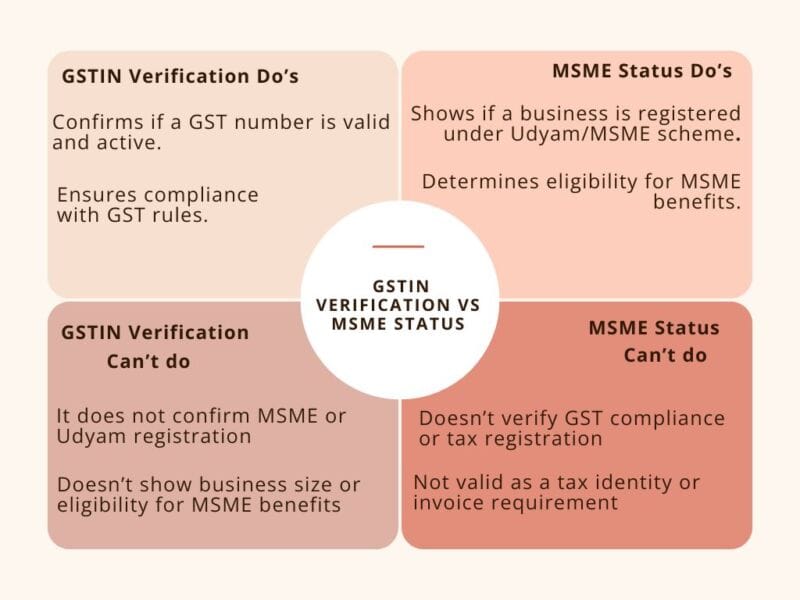

GSTIN Verification vs MSME Status: What You Can and Can’t Do?

The first instinct is simple. You type a GSTIN into a search bar and expect to see MSME status right next to tax details. But it doesn’t work that way. The GST portal tells you about tax identity—legal name, trade name, PAN, state code. The Udyam portal tells you about MSME status—category, certificate, date of registration. They live in different places.

So when you only check GST, you only see half the story. To get the full picture, you need to connect GSTIN with PAN, and then use PAN on the Udyam portal. That’s the bridge most people miss.

Some suppliers add another twist. Not every MSME has a GSTIN. Smaller businesses under the tax threshold may skip GST registration altogether. If you rely on GST-first checks alone, you will miss genuine MSMEs completely.

Here is the clear cut view:

- GSTIN check shows tax identity, not MSME status.

- Udyam check shows MSME status, not GST records.

- The bridge is PAN or the Udyam Registration Number (URN).

- Some MSMEs will not appear in GST at all if turnover is below the threshold.

That is the boundary line. Use GSTIN to confirm who you are paying. Use Udyam to confirm if they qualify as MSME. Tie the two together with PAN or URN, and your verification flow is complete.

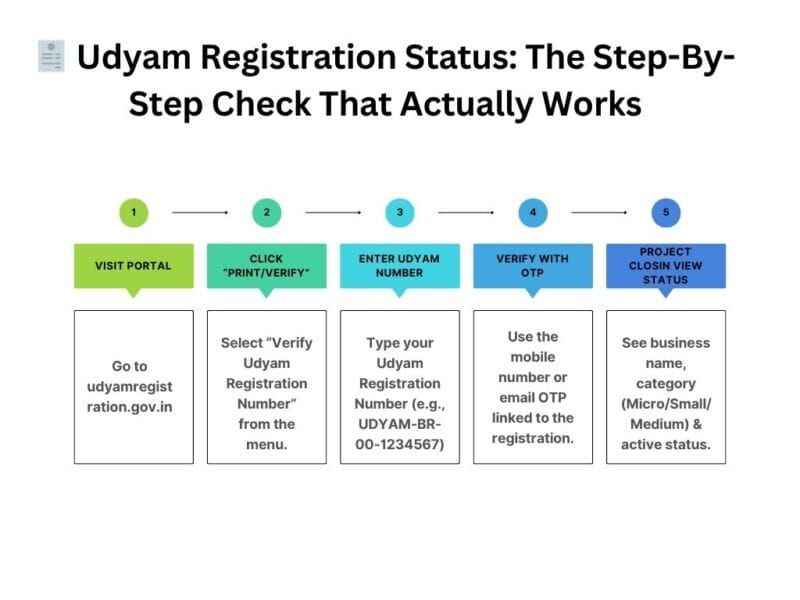

Udyam Registration Status: The Step-By-Step Check That Actually Works

Here’s the thing. You do not have one single road to MSME verification. You have two tracks. One works when the supplier gives you their Udyam Registration Number. The other works when all you have is a GSTIN. And then there’s a third path for vendors too small to carry GST at all.

If you already have the Udyam Registration Number (URN)

- Go to the Udyam portal search page.

- Type in the URN exactly as given. One missing digit and you get nothing.

- Validate with OTP if the page asks.

- Confirm the result: enterprise name, address, NIC code, MSME category (micro, small, or medium), registration date, and active status.

- Save a PDF or screenshot. Drop it in your vendor file with today’s date.

This is the cleanest route. If URN is valid, you get the proof straight from source.

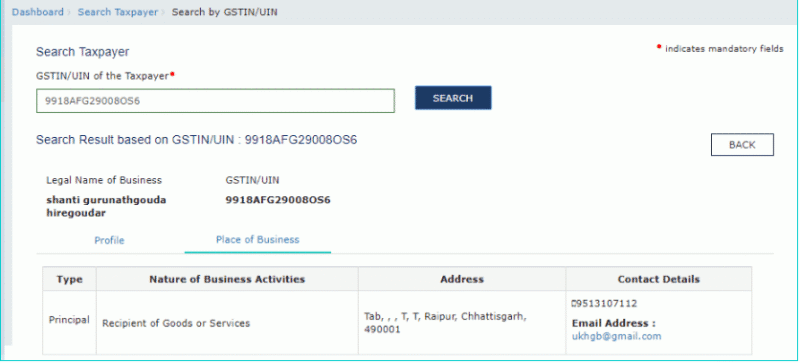

If you only have GSTIN

- Open the GST portal and search the GSTIN.

- From the GSTIN profile, pull out the PAN segment. GSTIN is 15 digits; the middle ten are PAN.

- Take that PAN and go to the Udyam portal. Search by PAN.

- Cross check: enterprise name, state, and spelling. Many slip-ups happen here.

- If the match is found, store the result. Include date and URL in your records.

This is the bridge route. GST gives you PAN. PAN gives you MSME status.

If there is no GSTIN

- Ask the supplier for URN and a copy of the Udyam certificate.

- Check it on the Udyam portal.

- If nothing comes up, ask for a written declaration stating why they do not appear. Record that in your file.

Small vendors below the GST threshold often stand here. It is still valid, but you need documentation.

At-a-glance Checklist

- URN or PAN must be present.

- Udyam status should read active.

- Category (micro, small, or medium) is noted.

- Enterprise name and address match the invoice.

- Evidence saved—PDF or screenshot with date.

Note: Direct GSTIN-to-MSME lookups do not exist on the Udyam portal. The bridge is always PAN or URN. Build your workflow around that, not around shortcuts.

Check MSME By PAN: Turning GSTIN Into PAN And Then Into Proof

This is where most teams pause. They have GSTIN on an invoice but no URN. They know MSME needs proof, but they are not sure what comes next. The next step is simple: crack GSTIN open to pull the PAN.

GSTIN has 15 characters. The middle ten are PAN. Once you have that, you can go straight to the Udyam portal and search by PAN. That search gives you MSME registration status, category, and the date of registration.

Why PAN works:

- PAN is constant. It does not change with state codes.

- PAN is tied to the legal entity, not the trade name.

- Udyam records are mapped to PAN, so this key always fits the lock.

But there are frictions. Names sometimes do not match word for word. A vendor might write the trade name on invoices while Udyam shows the legal name. A sole proprietor may use a personal PAN, which looks odd until you confirm it matches the GSTIN. State codes also matter. If a GSTIN carries one state but the Udyam record shows another, ask why. It could be a branch setup or it could be an error.

Clean Documentation

Keep it tight.

- Save the PAN mapping note from GSTIN.

- Save the Udyam portal result from the PAN search.

- Add a one-line note: who checked, when, and initials.

Then move on. Overthinking mismatches wastes time. If the essentials line up—PAN, MSME category, and active status—you have done your job.

If you cannot evidence it, you did not verify it. That one line should sit at the top of every vendor master file.

Udyam Certificate Verification: Red Flags and Recordkeeping

MSME status is only as strong as the paper trail behind it. Vendors will hand you certificates, screenshots, sometimes even WhatsApp forwards. Your job is to separate fact from noise.

Red Flags to Watch

- Name mismatch. The certificate shows one entity, the invoice shows another. That is not a typo, it is a signal to pause.

- URN with no record. You type the URN into the Udyam portal and nothing comes up. Either the number is fake or the registration is cancelled.

- Refusal to share URN. A supplier who claims MSME benefits but dodges when asked for URN is hiding something.

- Shifting category. Today they say micro, next week they say small. MSME category does not bounce around like that.

Good Practices for MSME Recordkeeping

Keep it boring, keep it clean.

- Save a PDF of the portal result with timestamp.

- Note the MSME category and registration date in your vendor master.

- Re-verify annually or whenever the vendor undergoes major changes.

This way, you do not scramble later. Everything is on file before the first payment is released.

Section 43B(h) MSME and Payment Compliance

Here’s where it bites. If the supplier is MSME and you miss the 45-day payment window, the expense deduction is gone. Auditors will flag it, tax outgo increases, and cash flow stumbles. Verification is not an afterthought. It is a shield before the contract is signed.

Payment policies must reflect MSME timelines. If they don’t, your books pay the price.

MSME Registration for Virtual Office Operators

This slice is often ignored. Virtual office operators onboard dozens of small firms every month. Many of these clients claim MSME status to grab benefits. Add URN to your KYC checklist. Keep a small script in your onboarding mail: “Please share PAN, URN, and MSME certificate.” That one line saves you from months of compliance trouble.

MSME Registration FAQs – GSTIN, Udyam, PAN, and Compliance

- Can I check MSME status by GSTIN alone?

No. GSTIN only shows tax identity. MSME status lives on the Udyam portal. Use PAN or URN to bridge the two. - What if a vendor has no GSTIN?

Still possible. Many micro enterprises fall below the GST threshold. Ask for URN and certificate. Verify on the Udyam portal. If they cannot show either, you should record that before onboarding. - What proof should I keep?

Always store a PDF or screenshot of the portal result, with date, URL, and initials of the person who checked. Evidence, not memory, keeps you safe during audits. - Does URN expire?

The number itself does not expire, but the status can change. Categories may shift from micro to small, or registrations may be cancelled. Re-verify once a year or on material change. - Is MSME the same as Udyam?

Yes in practice. MSME registration today means Udyam registration. Older certificates have been shifted into Udyam. - Why does spelling matter in searches?

Because the portal search is literal. “ABC Enterprises Pvt Ltd” is not the same as “ABC Enterprise Private Limited” in the system. Match the legal name, state, and district exactly, or you will think no record exists.