GST Cancellation in India: Step-by-Step Process, Forms, Timelines, and Checklist (2025 Update)

Businesses change shape. Some pause. Some shut. Some move states or merge. When that happens, cancellation of GST registration is not a footnote. It is the switch that ends tax invoicing and kicks off a clean exit. Founders, SMEs, freelancers, e-commerce sellers, this guide gives you the exact steps, forms, and timelines, plus the order in which you should act. No fluff. Just what to file, when to file it, and what happens after

Here’s the straight route on how to cancel GST registration. File REG-16 on the portal, set an effective date, declare stock and ITC reversal, then file GSTR-10 within three months. If the department cancelled you first, fix filings and seek revocation via REG-21. Full steps and forms are below, so you can stop guessing and get it done. But before that, you need to know what cancellation of GST registration actually means.

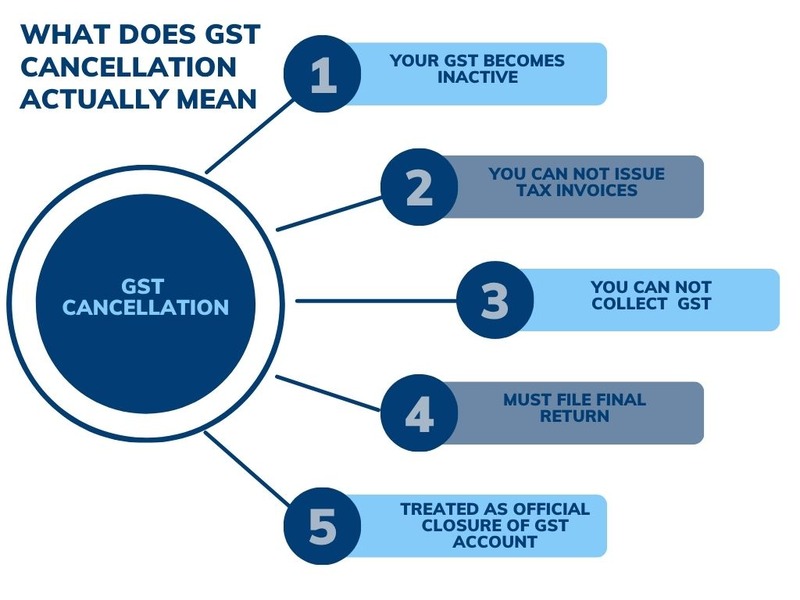

What Does GST Cancellation Actually Mean?

Cancellation of GST registration is not just a button you click and walk away. It’s a legal close. Once approved, your GSTIN (Goods and Services Tax Identification Number) becomes inactive and you can no longer issue tax invoices or collect GST from customers. But there’s still a final round of closure. You must file GSTR-10 — the Final Return — within three months of cancellation or the order date, whichever comes later.

This return isn’t ceremonial. It discloses all closing stock and capital goods, computes liability, and reverses unutilised Input Tax Credit (ITC) on remaining goods. It’s the government’s way of confirming that your books are square before you leave the system. Think of it as a financial signature that says, I’ve settled my dues, you can close my file. That’s what the GST registration cancellation process ultimately does — it ends compliance but demands accuracy till the last rupee.

When Should You Cancel GST Registration?

You don’t cancel GST registration because you feel like it. You do it because your business crossed a point of change. Here’s when you should:

- Business closed: If your trade, profession, or firm has ceased operations.

- Turnover below threshold: If your sales drop below ₹40 lakh (or ₹20 lakh for services), and you no longer need registration.

- Change in constitution: Partnership turned private limited company, or a proprietor joined hands — same business, new entity.

- No business started: If you took GST registration but never began operations within six months.

- Shift to another state: GST is state-specific; if you move your base, close one and open another.

In each of these cases, it’s better to deregister for GST rather than let the portal flag you for inactivity. Staying registered without filing returns only builds penalties. A clean cancellation keeps your tax record intact and avoids notices later.

Pre-Checks and Documents Needed to Cancel GST Registration Online

Before you reach the “cancel my GST registration” button, pause and clear the basics. Every pending return — GSTR-1, GSTR-3B, GSTR-9 if applicable — must be filed first. Check that there are no late fees or interest dues sitting in your electronic liability ledger. Reconcile Input Tax Credit across your purchase register and GSTR-2B. Then compute the ITC reversal on closing stock and capital goods you’ll declare in the cancellation form.

Gather documents in soft copy (PDF/JPEG within 1 MB each):

- PAN and GSTIN certificate of the business.

- Proof of address for the principal place of business — electricity bill, rent agreement, or ownership deed.

- Board resolution or declaration of closure, if you’re a company or LLP.

- Any license cancellation (FSSAI, trade, or professional registration) that supports your reason.

- Bank statement or closure proof, if the business account is being wound up.

All these will go into REG-16, the GST registration cancellation form, as supporting evidence for your reason. If you miss one, the officer can raise a query that slows the order down. The aim is simple: a full, self-contained application that leaves no space for doubt.

How to Cancel GST Online: Step-by-Step Guide

If you’re wondering how to cancel GST registration online, here’s the exact route to follow:

- Login to gst.gov.in with your credentials.

- Navigate to Services → Registration → Application for Cancellation of Registration.

- The portal opens Form REG-16. Select the reason for cancellation from the dropdown — closure, turnover below limit, transfer, or others.

- Set the effective date — this is usually the date business ceased or will cease.

- Declare stock and capital goods on hand. Compute ITC reversal payable (the higher of credit availed or output tax on goods).

- Upload documents that justify your reason and prove closure.

- Verify the application using DSC (Digital Signature Certificate) or EVC (Electronic Verification Code).

Once submitted, an Application Reference Number (ARN) is generated instantly. This is your proof of filing. The registration may be temporarily suspended during verification, meaning you can’t issue tax invoices or make fresh filings until the officer decides. Keep that in mind if you still have pending transactions — close them before you apply.

This single workflow is the full answer to how to cancel the GST registration from the portal itself, without visiting any department office.

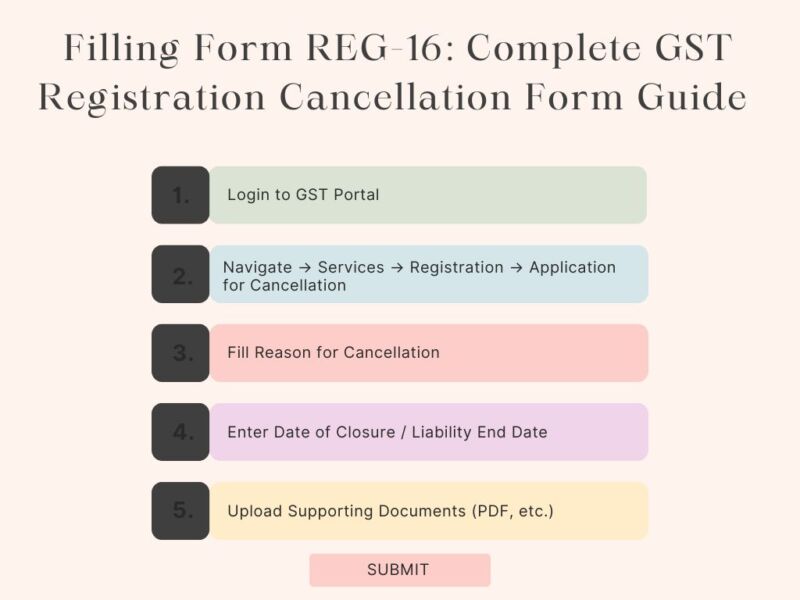

Filling Form REG-16: Complete GST Registration Cancellation Form Guide

REG-16 is simple, but precision matters. When you open the form, the first field asks for the reason for cancellation — pick what fits exactly, not what sounds close. If you shut shop, choose discontinuance of business. If you restructured, choose change in constitution leading to new PAN. Avoid vague options like “others” unless you have a detailed note.

Next, set the effective date carefully. It should be the date your business actually stopped issuing invoices or making taxable supplies. Enter a later date and you’ll owe unnecessary returns. Enter an earlier one and your filings may mismatch.

When you declare stock and capital goods, list everything you hold on that effective date — raw materials, finished goods, tools, computers, and vehicles used for business. The portal auto-computes ITC reversal once you key in taxable value.

Attach supporting proofs that match your stated reason: lease termination for closure, incorporation certificate for transfer, or board resolution for dissolution. Small mismatches — like different closure dates across documents — can delay approval. The cleaner your REG-16, the faster your REG-19 order. That’s the practical rule of the GST registration cancellation process.

After Applying: What Happens Post Submission of GST Cancellation Form?

Once REG-16 is submitted, your registration status turns “Suspended” in the portal. It’s temporary, but you must stop issuing tax invoices or collecting GST immediately. Within a few weeks, your jurisdictional officer reviews your application.

If all documents check out, you’ll receive a Cancellation Order in Form REG-19, which mentions your effective cancellation date and any tax payable. If the officer needs clarification, you’ll get a query on the portal asking for additional documents or explanation. Reply promptly — delayed replies can keep the application pending indefinitely.

This is the formal close of your GST registration. From here, only one step remains — filing the final return, GSTR-10, to settle everything legally and financially.

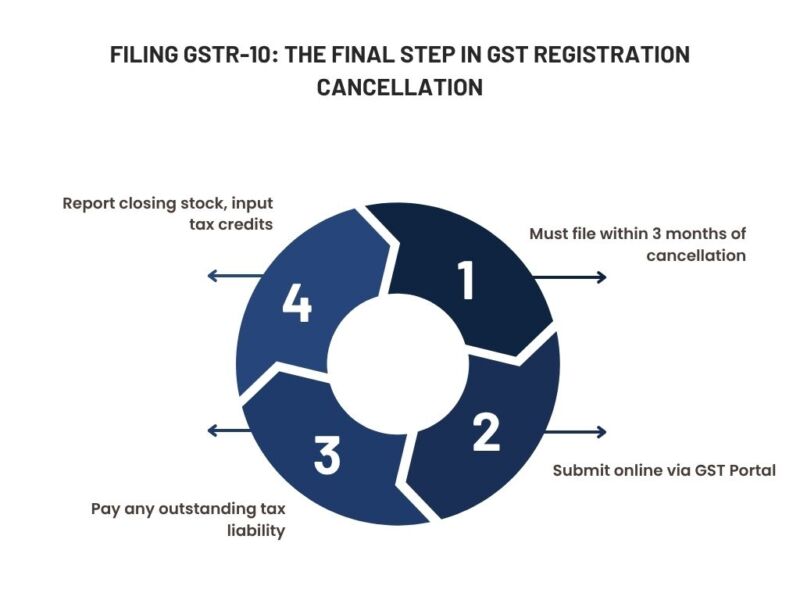

Filing GSTR-10: The Final Step in GST Registration Cancellation

Once your GST registration is cancelled, the portal expects closure, not silence. Within three months of the cancellation date or order date (whichever is later), you must file GSTR-10.

This form serves one purpose — to declare all tax liabilities up to the closure date. It asks for details of closing stock, capital goods, input tax credit reversals, and any outstanding dues. You can file it online under Services → Returns → Final Return.

If you miss this deadline, the system auto-flags you, and your jurisdictional officer can issue notices demanding explanation and payment of tax plus penalties. So don’t treat GSTR-10 like an optional form — it’s a statutory full stop.

To simplify:

- Report stock held on the effective cancellation date.

- Disclose ITC reversal on goods, inputs, and capital items.

- Pay any tax liability along with interest if applicable.

Once GSTR-10 is acknowledged, your GSTIN is formally closed and reflected as inactive in the public search records. That’s when you can safely say the process of how to cancel GST registration is complete.

Understanding ITC Reversal on GST Cancellation (Including Capital Goods)

Here’s how reversal works — and why you can’t skip it. Under Rule 44 of the CGST Rules, you must pay back the Input Tax Credit availed on goods and capital goods you still hold when your registration is cancelled.

The formula is direct. You pay the higher of:

(a) the ITC you had originally claimed on that stock, or

(b) the output tax calculated on the current value of those goods.

For capital goods, it’s slightly different. The credit is reversed proportionately, assuming a useful life of five years (60 months). If you’ve used the machinery for 24 months, you reverse ITC for the remaining 36 months.

Keep the calculation sheets, purchase invoices, and depreciation schedules ready — they are your defense if the officer seeks a reconciliation later.

It’s good practice to file this reversal even if the amount seems minor. Leaving it unreported can block your cancellation order or trigger future notices. The cleaner your ledgers look, the faster your closure order moves. That’s how you make the GST registration cancellation reason self-contained and final — with accurate numbers and proof in hand.

Departmental Cancellation and Revocation of GST Registration Explained

Sometimes, you don’t initiate cancellation — the tax department does. This usually happens when you stop filing returns or when discrepancies appear between your filings and actual business activity. The flow begins with a show-cause notice in Form REG-17, asking why your registration shouldn’t be cancelled.

You have seven working days to reply through Form REG-18, stating reasons and attaching proofs like return acknowledgments or tax payment challans. If your response satisfies the officer, the notice is dropped with Form REG-20. If not, the officer issues an order of cancellation in Form REG-19, specifying the effective date and liabilities.

Now, if your registration was cancelled by the department but you’ve corrected the non-compliance — for example, by filing pending returns or paying dues — you can request restoration. This is done via revocation of cancellation using Form REG-21. Submit it within 30 days from the cancellation order, explaining how the defaults were fixed.

Once verified, the officer issues an approval in Form REG-22, reinstating your GSTIN. If you miss deadlines or skip details, your revocation may be rejected, and you’ll have to appeal separately.

In short, revocation of GST registration gives businesses a second chance. Revocation of cancellation of GST registration is your path back into compliance, provided you’ve filed everything due and explained your case clearly.

Key Timelines and Common Reasons for GST Cancellation Rejection

Timelines are strict. REG-16 can be filed anytime, but you must follow through quickly. The officer’s REG-19 order typically arrives within a few weeks, depending on jurisdiction. After that, the clock starts for GSTR-10 — three months only.

Common reasons for rejection or delay include:

- Incorrect or vague reason for cancellation (e.g., choosing “others” without an explanation).

- Missing or inconsistent supporting documents.

- Stock or ITC reversal not matching returns.

- Pending filings at the time of submission.

- An unrealistic effective date (future dates or mismatched dates with closure proof).

Always reconcile ledgers before applying. A full, clear, and error-free REG-16 with accurate supporting data reduces officer intervention and makes your cancellation quick, traceable, and final.

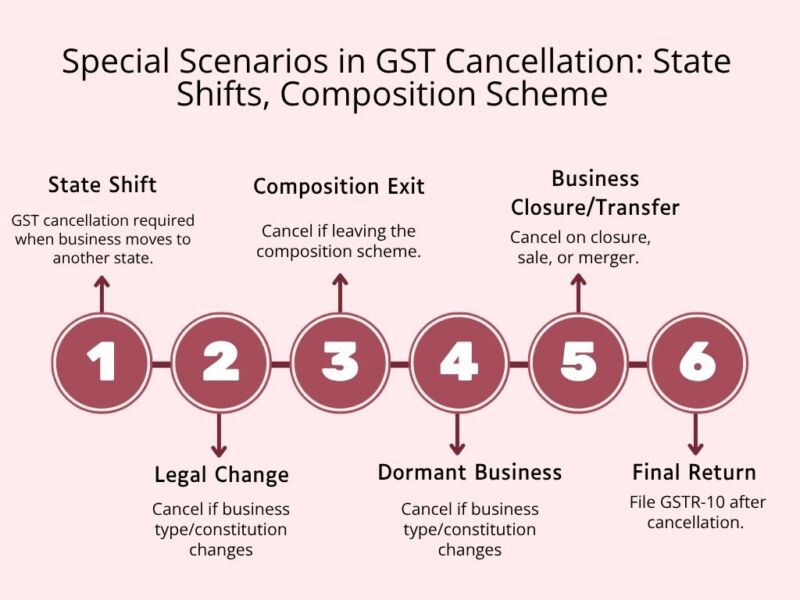

Special Scenarios in GST Cancellation: State Shifts, Composition Scheme & More

Certain transitions confuse even experienced business owners. Here’s how to handle them cleanly within the GST framework.

- Changing states or shifting address: GST registration is state-specific. If you move your business base to another state, you can’t just update the address. You must cancel the old registration in that state and apply for a new GSTIN in the destination state. During overlap, you may hold both registrations temporarily, but only if you’re supplying from both locations. Once transition is complete, close the earlier one with REG-16 and file GSTR-10 for that state.

- Composition taxpayers and casual taxable persons: If you opted for the Composition Scheme, remember it’s valid only for the period you actively supply goods or services. When you stop, file your stock statement and pending taxes, then proceed with cancellation. Casual taxpayers, often temporary exhibitors or event sellers, must file the Final Return immediately after the period of validity lapses.

- E-invoicing and e-way bills: Once your GST registration is cancelled, your access to the e-invoicing portal and e-way bill system stops. Download every invoice, e-way bill, and acknowledgment before applying. They’re often required for post-cancellation audits or refunds.

- Pending refunds or credits: Apply for any eligible refund before filing REG-16. Post-cancellation, refund claims can become time-barred unless specifically allowed.

Each of these special cases ties back to one principle: the GST system treats every registration as a living record of supply. You close it only after tying up every operational, legal, and accounting thread neatly.

Post-Cancellation Checklist: What to Do After Your GST Registration Ends

Once your GSTIN is cancelled and the final return accepted, take time to clean up what remains. Start by updating your bank KYC and trade licenses to reflect “GST registration cancelled.” Inform your vendors and clients that you’re no longer issuing tax invoices; this avoids mismatched ITC claims on their end.

If you import or export, update your IEC (Import Export Code) records, since GSTINs are often linked.

Internally, archive everything: return acknowledgments, invoices, ledgers, and correspondence with officers. Keep them for at least six years, as audits or departmental verifications can revisit old years even after closure.

This is the unseen half of the process — the quiet work that ensures your business stays compliant and credible even after it’s no longer active. That’s the disciplined way to cancel your GST registration and move forward without loose ends.

How a Startup Successfully Cancelled Its GST Registration

Picture a small design startup in Delhi winding down operations in mid-2025. They file all pending GSTR-3B and GSTR-1 returns, settle dues, and compute ITC reversal on closing laptops, office furniture, and unsold merchandise. Through the GST portal, they open Form REG-16, select “discontinuance of business,” upload their closure resolution and lease termination letter, and submit with EVC verification. Within a few weeks, they receive the REG-19 cancellation order. They then file GSTR-10 within three months, disclose closing stock, pay ₹14,000 in ITC reversal, and update their bank and IEC records. The result — clean books, no notices, and peace of mind. That’s what an ideal GST registration cancellation process looks like in practice.

Quick GST Cancellation Checklist for a Hassle-Free Closure

- File all pending returns (GSTR-1, 3B, 9 if applicable).

- Clear dues and reconcile ITC.

- Gather documents: PAN, address proof, closure evidence.

- Submit REG-16 with stock and capital goods details.

- Wait for REG-19 cancellation order.

- File GSTR-10 within three months.

- Reverse ITC on goods/capital assets.

- Update banking, IEC, and vendor records.

- Archive returns and invoices for six years.

Follow this path and you’ll never have to ask how to cancel GST registration again.

Legal References and Final Note

CGST Rules 20–23; official GST portal documentation.

This article is for informational purposes only. Confirm the specifics with your CA or jurisdictional GST officer before acting.

FAQs

- Which form is used to cancel GST?

You’ll need Form REG-16 for voluntary cancellation. It’s filled online through the GST portal under Services → Registration → Application for Cancellation. If the department starts the process, they issue a show-cause in REG-17, you reply with REG-18, and they pass an order using REG-19 or REG-20. - What is the due date for GSTR-10?

You must file GSTR-10 within three months from the effective cancellation date or the order date, whichever is later. It’s the final return that reports closing stock, ITC reversals, and any dues. Late filing attracts a daily fine and can delay closure. - Can I cancel it myself online?

Yes. Visit the GST portal, log in, go to Services → Registration → Application for Cancellation, and open REG-16. Fill in your reason, date, and stock details, upload closure documents, and verify through DSC or EVC. Once you submit, you’ll receive an ARN and your registration status changes to Suspended until approval. - Can a cancelled GST be restored?

Yes, if the department cancelled it. File a revocation application in REG-21 within 30 days, after clearing pending returns or dues. Once approved, the officer issues REG-22, restoring your GSTIN and letting you continue business normally. - Do I need to reverse ITC on closing stock?

Yes. When you cancel GST, you must pay back credit claimed on goods or capital goods still in hand. Report it in REG-16 and GSTR-10, based on whichever is higher — ITC taken or output tax on those goods. - How long does the whole cancellation take?

Usually two to four weeks, depending on the officer’s review. If your forms and filings are complete, the order in REG-19 arrives quickly, followed by final closure once GSTR-10 is filed.